Pages 1 2 3

Chapter 3 - page 2

Six months after trading began, the deficit on the Westport system account was equivalent to 80% of the monthly turnover10

, which seemed a lot. On the other hand, it was only 300Rs (approx £15) per head for each of the 65 members, which seemed nothing in comparison with the value of the system we had built up. Eventually we reduced the deficit by holding a party which people paid to attend. LET systems should always organise plenty of parties as experience shows that members generally trade only with other members they know, so an enjoyable event strengthened our system in two ways.

But what was the Westport system's value? In economic terms it is fair to say that, so far, most LETS systems have been disappointing. The Stroud system has a monthly turnover per member equivalent to only £15, which probably amounts to less than 5% of participants' average monthly incomes. In Katoomba, the comparable sterling figure would be around £20 a month, and Westport’s is much the same. Similar figures were produced by a survey of five English systems by Jyll Seyfang which showed that even when the 30% least active members were excluded, turnover per head ranged from a miserable £75 to a respectable £220 a year.11

These figures hide more than they reveal. In general turnover is low in Britain because the Department of Social Security does not permit anyone who is unemployed to participate in a LET scheme without risking losing all or part of their weekly benefit. This is on the grounds that for at least some of the period for which the benefit is paid, the claimant was 'unavailable for work' - despite the fact that in most cases no jobs with wages payable in national currency were available. As a result, not one unemployed person became involved in Stroud LETS in its first two years' trading, although the jobless are one of the social groups which stand to gain most from LET schemes. My impression is that British LETS members are generally people with low national currency incomes and some free time who join up for pleasant optional extras which they would otherwise be unable to afford. "Your members are only getting involved to the extent that they can afford to lose" an Eastern European visitor told the Stroud co-ordinator, Sandra Bruce, on one occasion. However, in Diss, Norfolk, Jyll Seyfang found them to be "predominantly middle-class people with ’alternative’ or ’green’ ideals and an adequate cash income who were attracted to the system by its relevance to these beliefs rather than for the economic benefits of the system."

Turnover per member is generally higher in the best Irish systems because the unemployed can participate wholeheartedly without risking their benefits. This happy situation came about because the Department of Social Welfare accepted arguments by Meitheal na Mart on behalf of all the Irish LET systems that it was in the public interest that the unemployed should be free to take part without loss of benefit because this would keep their skills alive, maintain their work habits and, since informal networks are so valuable to jobhunters, raise their chances of hearing about national-currency-paid jobs. Participation was also likely to maintain their health, we said, because many studies had shown the damaging effect that unemployment has on the health of the people experiencing it and their families, and therefore save the state resources it might otherwise have to had to spend on medical, psychiatric and social care. In August 1993, only two months after the first Irish system had started trading, the Department wrote a letter saying that it would not withhold benefits so long as LET systems did not 'begin to encroach on regular taxed and insured employment.' Such an encroachment would not, of course, be in anyone's interest and, immediately after the letter came, the Westport group introduced a rule which restricts members from doing more than 32 hours work a month on a regular basis for any one person for which they are paid in Reeks. We have also tried to convince our members that, now that a LET system is running, they should never pay cash to anyone working in the black economy. If they do, we point out, they will undermine both the national social welfare system and their own local currency network.

Both the New Zealand and Australian governments have adopted the same policy as the Irish and do not withhold welfare benefits from LETS members. Including single parents and pensioners, over half the Westport participants are on some type of social welfare benefit and LETS has greatly improved the quality of their lives. One young couple, she unemployed, he temporarily disabled after an accident, used the system to transform the garden of a semiderelict cottage they had just rented: rank grass and scrub was cut, a 200-tree shelterbelt planted and a rockery and herb-garden built and stocked. "If we had been paid in real money rather than Reeks, we'd never have felt able to spend it this way. Other things would have seemed more important" the husband told me. "But it's had a wonderful effect on the house and how we feel about living here."

In fact, as with most things in life, those who put most effort into a LETS get most out of it and every survey seriously underestimates the systems' economic importance to particular members. Just eliminating those members who did not trade in a particular month increases the average turnover in Westport to £30, for example, and the average level of trading each month by the most active 25 members over an eight-month period was £40, with the top four participants doing over £100 a month each. Other Irish systems do much more. In the Beara peninsula in West Cork, where a great deal of effort has been put into building a strong system, the weekly stall did £600 worth of business in a single four-hour period in November 1995 and the most active 25 members are estimated to do an average of £120 business each every month. In East Clare, the record sales figure for the system’s stall which operates only one day a month is £800.and its 25 most active members are estimated to do an average of £80 worth of business each a month.

The main thing any community contemplating starting a LETS should realise is that getting the system running is not enough and a local currency cannot show its full potential until those behind it have made a a real effort to develop businesses doing a substantial part of their trade through it. These businesses obviously get an enormous marketing advantage over firms which have to insist on 100% payment in pounds or dollars and effectively acquire a degree of protection against outside competition which, as we have discussed, national governments are no longer allowed to provide. In addition, to the extent that they can spend local units instead of national ones to cover their start-up costs, they can benefit from what is, in fact, an interest-free loan.

Naturally, a business selling a proportion of its output for the local unit will have to pay for some of its inputs in that unit too, and the willingness of its workers to accept part of their pay in the local unit could be crucial to its establishment and survival. Initially, these firms can be expected to have to limit the proportion of business they do for local money but as the number of them grows and linkages between them develop, the limits will relax and the amount of national currency which individual LETS members need to live their daily lives will fall..

The members-only nature of a LET system can be used to create commercial advantages. For example, it provides a way around EU food preparation, labelling and hygiene regulations which might otherwise make it financially impossible for anyone to begin making food products on a small scale. When an environmental health officer called at the Westport LETS stall recently, he told the member minding it that, as the food available there was only sold to members, the conditions under which it was made were of no legal concern to him. Other EU restrictions might not apply too. For example, it might be possible for a farmer to supply milk to other members through a LET system without it counting towards the sales he is allowed to make under his milk quota.

Click for panel from original book on cash attitudes versus LETS attitudes

In its early days, all one can expect economically from a LET system is that it provide a useful supplementary income for the weaker members of the community and a safety net to which the stronger may have to turn if the world economy crashes. That’s a lot in itself but the real benefits at this stage are not so much economic as personal and social and many members feel that it would be worthwhile launching a system for these alone. On the personal level, being forced to think of services to offer other members enables people to escape from the confines of their job and develop skills which would otherwise have lain dormant. For example, many people play a musical instrument reasonably well but would never dream of advertising for engagements in the local paper. But when a fellow-member of their LET system asks them to play at a party, they are delighted to do so, not because of the local currency they will earn - that just shows that their ability is valued - but because of the fun they will have giving pleasure to others. Trading through LETS, particularly if they do not confine their activities to their normal professions, introduces members to a wider circle of people than they would have probably come to know so well in any other way. A member of the Newbury system wrote in the LETSlink Newsletter that a 'virtual village' had been created in her town since trading began 12

Despite these benefits, a LET system will only work well if there is underemployment and an inadequate supply of national currency in a region or amongst a social group: if everyone is fully occupied and finds that their activities are not seriously restricted for lack of cash, why should they bother to join a LETS and what economic benefits could it bring them if they did? A Time Dollar system (see panel) would be better in such a community.

Click for panel from original book on Time Dollars

Click for panel from original book on Womanshare

LET systems are therefore very vulnerable to changes in the state of the mainstream economy. Since every LETS member prefers to be paid in national currency whenever it is available because that currency can be spent on a wider range of things, LET schemes will tend to develop during recessions as the national currency gets scarcer and to weaken or collapse whenever the national economy improves. In my view, it was the improvement in the Canadian economy in the mid 1980s which hit Michael Linton's original LETS in the Comox Valley, although he attributes its period of dormancy before it was revived by a women’s group to the departure of a dentist who had been prepared to take payment in the local unit while he was reconstructing his surgery so that he could spend the proceeds on the building work.

"Our problem was that although we had 600 account-holders at one point, we never had more than about five shops which would accept our Green Dollars" Linton told me. "And these weren't large shops either. So when the dentist left the district, a lot of the builders and handymen who had joined the scheme in the early days and had sent their families to him for treatment found that they couldn’t spend their Green Dollars that way and they weren’t greatly interested in the services of the rest of the members, like the single mothers offering babysitting or aromatherapy." So the tradesmen stopped working for Green Dollars, which left the rest of the members with nothing major that they really wanted to buy either as they had been treating the LETS primarily as a way to get their houses done up. Trading more or less stopped. Linton disagrees with my theory that the underlying reason the builders stopped participating was not that the dentist had gone but that the economy had improved and they found it easier to get paid in cash. His explanation and my theory are not incompatible and both probably contain part of the truth. However, there is no doubt that the Comox experience underlines the importance of ensuring that people's real needs, as opposed to their peripheral pleasures, can be met through a LETS.

Comox Valley LETS was by no means the first local currency experiment.and Linton says that he spent almost a year researching earlier systems before launching it. "All the components of LETSystems were drawn from other sources but the precise arrangement of them seems to [have been] unprecedented" he says. The commercial barter networks were one source and the Useful Services Exchange established in Reston, Virginia, by Harry Ware in the early 1970s was another. Where Ware got his ideas I have been unable to discover but records of people setting up systems to enable exchanges to take place without the use of official currency go back a long way. In 1696, for example, a Quaker, John Bellers, proposed that unemployed workers be paid in labour notes for goods they had produced with materials supplied by the system's central office. The office was to recover its notes by selling the goods either to the workers themselves or to others who had received notes from the workers in payment for food or rent. The idea was tried out in Bristol and failed but was revived almost 140 years later by the philantropist Robert Owen, who republished Bellers' book. Owen, however, was no more successful than Bellers: his National Equitable Labour Exchange opened in 1832 and closed less than two years' later. The Bank of Exchange set up in 1848 by the French socialist Pierre-Joseph Proudhon, best known for his view that property is theft, was an equally unsuccessful variation on Bellers’ idea.

For our purposes, however, the most relevant experiments with local currencies were carried out in the 1930s in response to severe shortages of national currencies at the time. These shortages arose mainly because a national currency has to perform two functions - that of a means of exchange so that people can express the value of different goods and services and transfer that value to each other, and also as a store of value which holders can save up until they are ready to buy. These roles can conflict with each other. During an inflation, for example, the monetary unit fails as a store of value, encouraging people to exchange their cash for goods as quickly as possible, thus speeding the inflation along. Conversely, when prices fall in a depression, those who can hold on to their money do so because they expect to be able to buy whatever they need more cheaply later on. Naturally, their hoarding removes money from circulation, thus reducing other people's ability to buy things and accelerating the rate at which prices fall.

Reichmark hoarding became a severe problem in Germany during the economically depressed period immediately after the First World War and the Freiwirtschaft (Free Economy) movement developed to tackle it. In 1919, one of its members, Hans Timms, set up an organisation to issue a supplementary currency based on the writings of a friend, Silvio Gesell, who after making made his fortune as an importer and manufacturer in Argentina had returned to Europe in 1906 able, as Keynes put it, "to devote the last decades of his life to the two most delightful occupations open to those who do not have to earn their living, authorship and experimental farming." 13

The currency was called the Wära, a combination of the words Ware (commodity) and Währung (a currency unit which preserves its value). Notes were issued for 0.5, 1, 2 and 5 Wära, each Wära being worth exactly a Reichsmark - indeed, it could be exchanged for one in emergencies since the entire proceeds from the sale of Wära notes were lodged in a redemption fund. The key difference between the Wära and the Reichsmark lay in the fact that the former were costly to hoard since anyone holding some at the end of a month had to buy special stamps costing 2% of each note's face value to re-validate them for use during the following month. Naturally, this meant that anyone who received Wära tried their best to spend them before they needed to be stamped again and the new currency began to circulate rapidly among Freiwirtschaft enthusiasts throughout Germany. Timms' organisation used the 2% monthly levy for promotional purposes.

The currency was called the Wära, a combination of the words Ware (commodity) and Währung (a currency unit which preserves its value). Notes were issued for 0.5, 1, 2 and 5 Wära, each Wära being worth exactly a Reichsmark - indeed, it could be exchanged for one in emergencies since the entire proceeds from the sale of Wära notes were lodged in a redemption fund. The key difference between the Wära and the Reichsmark lay in the fact that the former were costly to hoard since anyone holding some at the end of a month had to buy special stamps costing 2% of each note's face value to re-validate them for use during the following month. Naturally, this meant that anyone who received Wära tried their best to spend them before they needed to be stamped again and the new currency began to circulate rapidly among Freiwirtschaft enthusiasts throughout Germany. Timms' organisation used the 2% monthly levy for promotional purposes.

Gesell got the idea of making it expensive to hang on to money from brakteates, the thin silver-alloy coins which were issued by the rulers of the dozens of small independent states in what had been Charlemagne’s Holy Roman Empire from the 12th to the 15th centuries and which were at least as risky to hold as any of the commodities they could be used to purchase. Most of this risk originally stemmed from the fact that they could lose up to a quarter of their value overnight because whenever a ruler who had issued a batch died, all the coins bearing his head became invalid and had to be exchanged, at a 20-25% discount, for new ones bearing his successor’s features. Predictably, however, rulers soon began to recall brakteates as a form of taxation, sometimes as often as three times a year. Johann II of France, who ruled from 1350 to 1368, changed his currency no less than 86 times.

Having to use money which lost its value so quickly meant that people spent it as soon as they received it since even holding it overnight involved a risk. So, according to Fritz Schwarz, a Gesellian writing in 1931, instead of saving this fast-depreciating cash, people spent any surplus sums they might have on improving their houses and property and he points to the fine houses relatively ordinary folk were able to build during the period 14. The construction work meant that there was a high demand for labour and wages were consequently good: an ordinary day-labourer could expect to earn six or eight groats a week which was enough to buy four pairs of shoes or two sheep. Working hours were short - there was trouble in Saxony when the mine-owners wanted to increase daily hours from six to eight - and there were at least ninety religious holidays a year. This meant that craftsmen, who took Mondays off to recover from over-indulgence on Sunday, worked less than a four-day week. It was a time of great prosperity, Schwarz claimed, with ’no difference between the farmhouse and castle’. Farmers wore coats with golden buttons and had silver buckles on their shoes.

Ironically, it was gold which brought this golden age to a close. A bracteate was generally ’a totally wretched and ugly little disk of metal, very thin, of low fineness, easy to lose, and easy to break’15 which had no intrinsic value because of its low silver content and was therefore useless for international trade, particularly as it could be recalled at any time. Realising this, the Genoese and then the Florentines issued gold coins in 1252 and Venice followed in 1284. These new coins could act as a store of value as well as a means of exchange and allowed people to build up their assets in ways that did not involve employing others and thus passing their surplus around.. Moreover, as they spread, trading itself became much more difficult :"The means of exchange disappeared into socks and mattresses" Schwarz writes and as money became scarce, interest rates soared despite the opposition of the church. Some merchants found it more profitable to sell off their stock and lend out their capital and a gulf developed widened between families with an income based on interest and the rest of the population. The demand for labour dropped, wage rates fell and unemployment appeared. And, to cap it all, rulers had to find other means of taxation.

Nobody in authority took much notice of the Freiwirtschaft currency until 1931 when the purchaser of a defunct coal mine at Schwanenkirchen, a village with a population of five hundred in Bavaria, was able to re-open it by paying the miners in Wära which he had arranged they could spend in the village shops. In their turn, the shopkeepers forced their wholesalers to accept Wära and the wholesalers passed them back to their suppliers, who spent most of the notes they received on buying Schwanenkirken coal since there were few other ways in which Wära could be used. According to an account published in August 1932 in an American magazine, New Republic, the effects on the village were dramatic: "One would not have recognised Schwanenkirchen a few months after work had been resumed at the mine. The village was on a prosperity basis, workers and merchants were free from debts and a new spirit of life and freedom pervaded the town....Reporters came from all over Germany to write about the 'Miracle'" . The article pointed out that if Reichsmarks had been used in place of Wära, they would have been hoarded because of the uncertain times and the venture would have failed. Moreover, even if they had not been hoarded they would have dispersed all over Germany and there would have been little likelihood of their returning to Schwanenkirchen and increasing demand at the mine.16

Although only 20,000 Wära were ever issued by Timms' central organisation, some 2.5 million people handled them in 1930-31 as a result of their high velocity of circulation. Their success in Schwanenkirchen terrified the German government which feared they would cause inflation and after an unsuccessful court action on the grounds that Wära infringed the state's sole right to issue money, it passed emergency legislation in November 1931 to bring their use to an end. The mine in Schwanenkircken closed and its workers were plunged back into unemployment.

Mutual Currency System Provides Businesses with Cheap Capital (click for panel from original book)

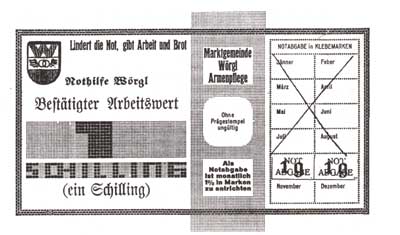

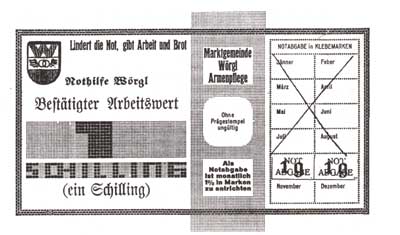

However, not far over the border in the Austrian Tyrol, another enthusiastic supporter of Gesell's ideas had been following events closely. He was Michael Unterguggenberger, the mayor of Wörgl, where local tax payments were seriously in arrears and the official treasury was in crisis because 1,500 of the town's 4,300 inhabitants were out of work. The type of auxiliary currency used in Schwanenkirchen - technically known as Stamp Scrip - seemed the answer and, after negotiating a loan from the local Raiffeisen (credit union) savings bank, the mayor printed notes with a face value of 32,000 Schillings in denominations of 1, 5 and 10. Only a third of these were ever put into circulation. In August 1932, the scrip was used to pay half the wages of the council staff including the mayor himself and, because the businesspeople of the town knew it could be used to pay local taxes they reluctantly accepted it in payment for goods, the fear of losing sales to competitors bringing stragglers into line. As the scrip, like the Wära, had to be stamped each month to maintain its validity. it was passed quickly from hand to hand, generating a rapid increase in trade. It was, in fact, spent in preference to national currency and in its first year, according to a 1952 German account24 of the experiment, each local note changed hands 463 times on average whereas a typical national note was involved in only 213 transactions. Quite soon only the railway station and the post office would not accept the local money.

Page 3 of Chapter 3

Pages 1 2 3

The currency was called the Wära, a combination of the words Ware (commodity) and Währung (a currency unit which preserves its value). Notes were issued for 0.5, 1, 2 and 5 Wära, each Wära being worth exactly a Reichsmark - indeed, it could be exchanged for one in emergencies since the entire proceeds from the sale of Wära notes were lodged in a redemption fund. The key difference between the Wära and the Reichsmark lay in the fact that the former were costly to hoard since anyone holding some at the end of a month had to buy special stamps costing 2% of each note's face value to re-validate them for use during the following month. Naturally, this meant that anyone who received Wära tried their best to spend them before they needed to be stamped again and the new currency began to circulate rapidly among Freiwirtschaft enthusiasts throughout Germany. Timms' organisation used the 2% monthly levy for promotional purposes.

The currency was called the Wära, a combination of the words Ware (commodity) and Währung (a currency unit which preserves its value). Notes were issued for 0.5, 1, 2 and 5 Wära, each Wära being worth exactly a Reichsmark - indeed, it could be exchanged for one in emergencies since the entire proceeds from the sale of Wära notes were lodged in a redemption fund. The key difference between the Wära and the Reichsmark lay in the fact that the former were costly to hoard since anyone holding some at the end of a month had to buy special stamps costing 2% of each note's face value to re-validate them for use during the following month. Naturally, this meant that anyone who received Wära tried their best to spend them before they needed to be stamped again and the new currency began to circulate rapidly among Freiwirtschaft enthusiasts throughout Germany. Timms' organisation used the 2% monthly levy for promotional purposes.